Manulife Investment Management has created an Investor Profile Questionnaire to identify your investor profile which will help determine the Manulife Asset Allocation Portfolio that is most appropriate for you.

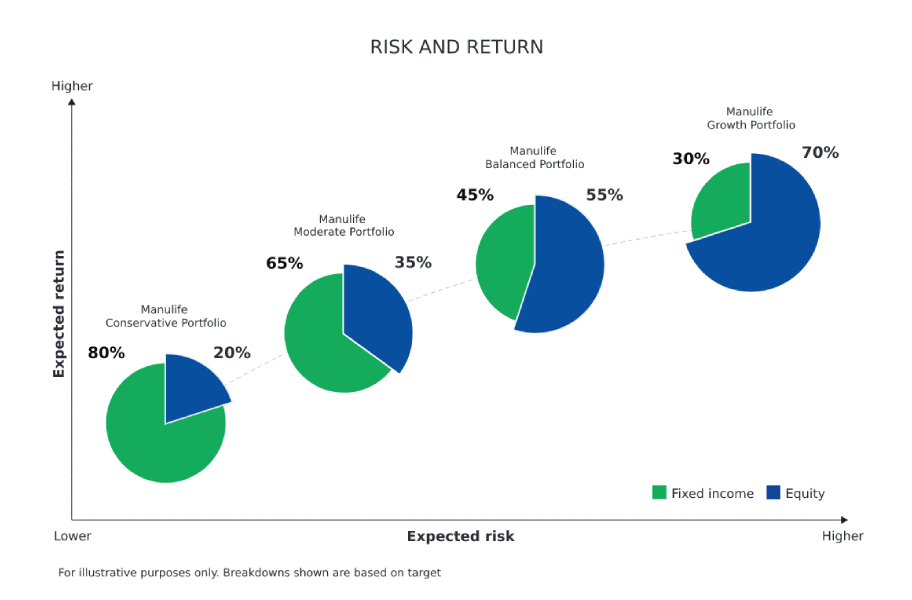

Illustration of the ratio of risk vs return in each of the four available portfolios. The portfolios from lowest risk and return to highest risk and return: Conservative, Moderate, Balanced, and Growth. The Conservative portfolio has 20% equity and 80% fixed income; the Moderate portfolio has 35% equity and 65% fixed income; the Balanced portfolio has 55% equity and 45% fixed income; and the Growth portfolio has 70% equity and 30% fixed income.

Manulife Asset Allocation Portfolios are available on both the mutual fund and the segregated fund platforms. In order to create your customized Investment Policy Statement, please select below which investment type you are interested in.

Are you interested in mutual funds or segregated fund solutions?

Mutual funds solutions Segregated fund solutions

The Manufacturers Life Insurance Company is the issuer of all Manulife segregated fund contracts and the guarantor of any guarantee provisions therein. Manulife Funds, Manulife Corporate Classes and Manulife Asset Allocation Portfolios are managed by Manulife Investments, a division of Manulife Asset Management Limited. Both products offer opportunities to help grow your wealth. Your advisor can help you find a solution that meets your needs.