Performance cannot be shown until one year after the Fund's inception.

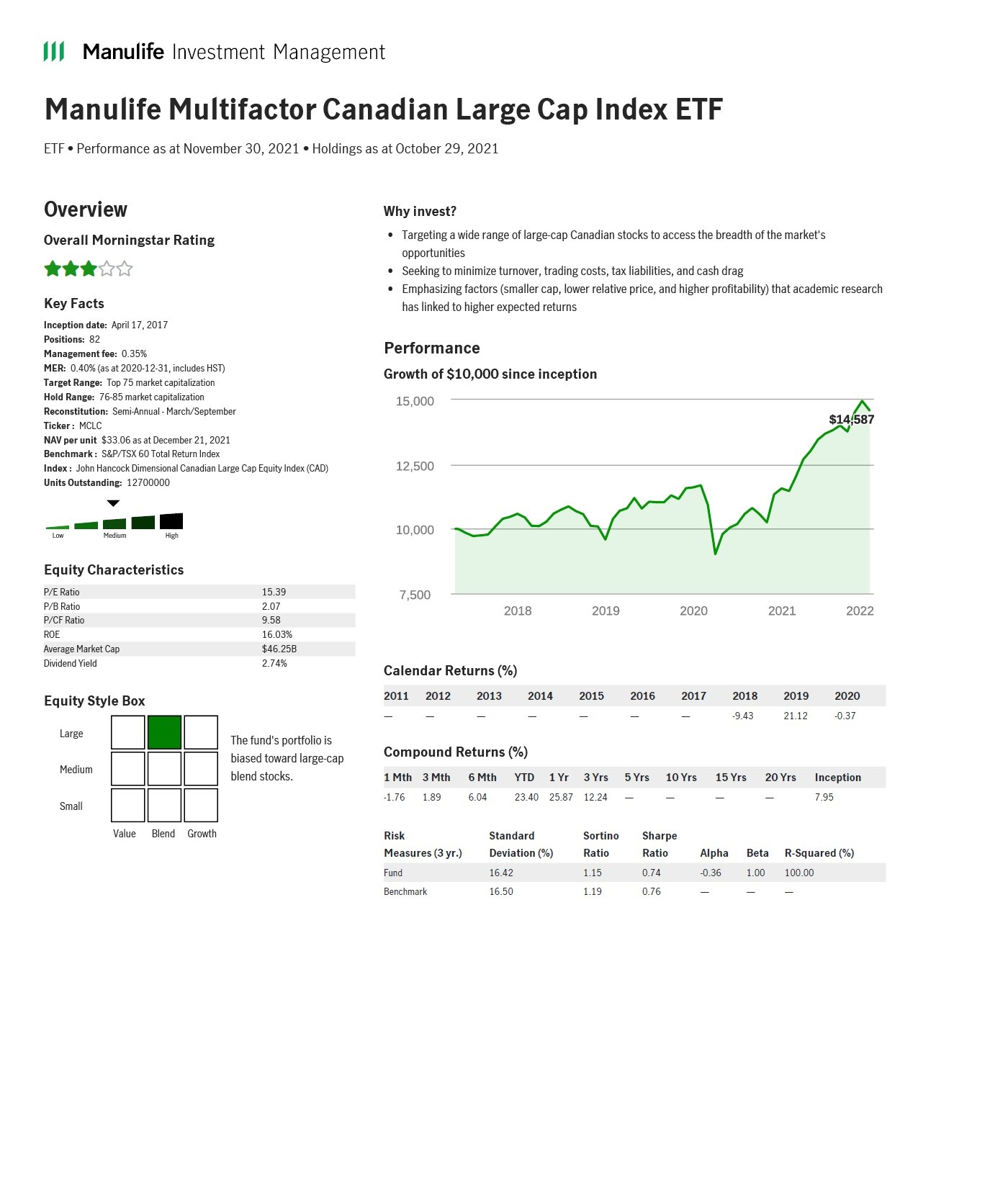

Overall Morningstar Rating

—

Risk:

Low

Medium

High

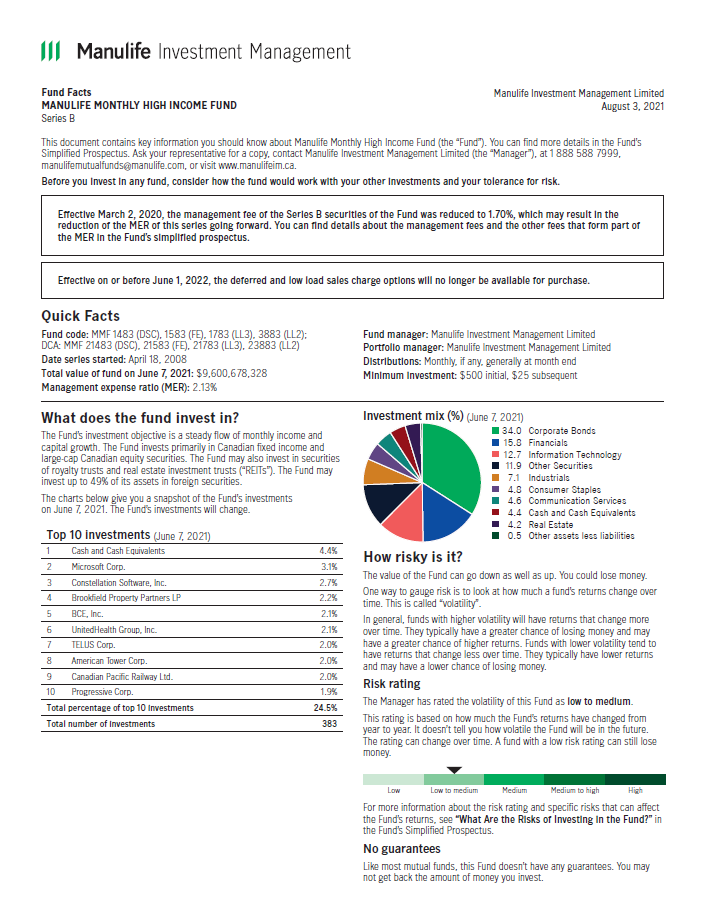

Fund code:

Why Invest

Management

Manulife Multi-Asset Solutions Team

Performance1, Prices & Distributions

Performance

Prices & Distributions

- 1 The “Growth of $10,000 invested” chart shows the final value of a hypothetical $10,000 investment in securities in this class/series of the fund without any withdrawal as at the end of the investment period indicated. This compound growth chart is for illustrative purposes only and is not intended to reflect future values or returns on investment in such securities.

Calendar Returns

Performance cannot be shown until one year after the Fund's inception.

Compound Returns

Performance cannot be shown until one year after the Fund's inception.

- Management Team:Manulife Multi-Asset Solutions Team

- Inception date:April 4, 2025

- Performance reset date:

- AUM2:$27.26M

- CIFSC category:Global Equity

- Investment style:

- Distribution frequency 3:Monthly

- Distribution yield4:

- Positions:184

- Management fee:0.72%

- MER:

- Min. investment:$500 initial; $25 PAC

- Fund Status:Open

- Risk:Medium

Portfolio Allocation

as of 2025-07-31

Asset

Region

Sector

Top 10 Underlying Fund Holdings 5

as of 2025-07-31

| Name | Weight % |

|---|---|

| Manulife Climate Action Fund | 34.84 |

| Manulife U.S. Opportunities Fund | 30.10 |

| Manulife Global Equity Class | 25.09 |

| Manulife Canadian Equity Class | 9.93 |

Documents

Know Your Product

Fund Profile

Fund Facts

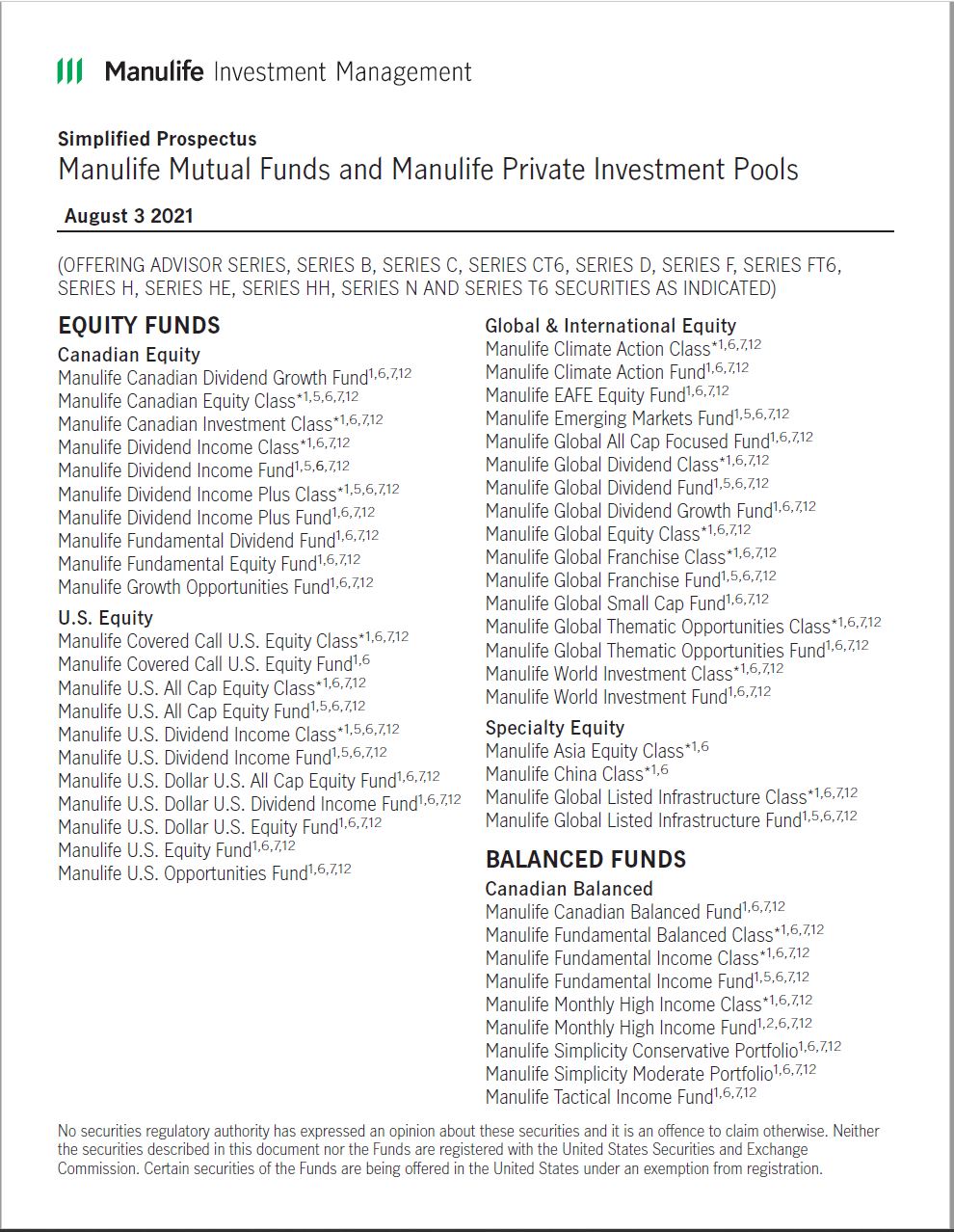

Prospectus

Fund Codes

Related

Fees

- Management fee0.72%

MER

(as at 2025-04-07, includes HST)

Management Fee Reduction6

| Account/Household Value Tiers | All Qualifying Investments |

|---|---|

| $250K+ to $499K | 2.50 basis points |

| $500K+ to $999K | 5.00 basis points |

| $1M+ to $4.9M | 7.50 basis points |

| $5M+ to $9.9M | 10.00 basis points |

| $10M+ | 12.50 basis points |

Title

- 1 The “Growth of $10,000 invested” chart shows the final value of a hypothetical $10,000 investment in securities in this class/series of the fund without any withdrawal as at the end of the investment period indicated. This compound growth chart is for illustrative purposes only and is not intended to reflect future values or returns on investment in such securities.

- 2 All classes/series combined. Assets as at August 29, 2025.

- 3 The payment of distributions is not guaranteed and may fluctuate. If distributions paid by the fund are greater than the performance of the fund, then your original investment will shrink. Distributions should not be confused with a fund’s performance, rate of return, or yield. You may also receive return of capital distributions from a fund. Please consult with your tax advisor regarding the tax implications of receiving distributions. See the fund facts as well as the prospectus for more information on a fund’s distributions policy.

- 4 Distribution yield is calculated based on prior 12-month rolling average of paid distributions and using average month-end net asset value, per security. The distribution yield excludes any year-end capital gains distributions paid. Distribution yield should not be confused with a fund’s performance or rate of return.

- 5 Holdings are subject to change. They are not recommendations to buy or sell any security.

- 6 Investors with a minimum investment in Manulife mutual funds, Manulife Private Mutual Funds and Manulife Private Investment Pools ("Qualifying Investments") of $250,000, either in a single account or in the aggregate based on the total assets of a financial group, are entitled to receive a reduction in the management fees that apply to their Funds. Such reductions are paid in the form of a distribution to investors (first out of net income and net realized capital gains of the Fund and, thereafter, as a return of capital) and in the form of a rebate to Manulife Corporate Class investors. In both cases, the reductions are automatically reinvested in additional securities of the relevant series. The amount of the distribution or rebate, as applicable, is based on the aggregate amount invested in the Qualifying Investments and begins on the first dollar invested. A financial group includes all accounts belonging to a single investor, their spouse, their respective family members residing at the same address and corporate accounts for which the investor and other members of the financial group beneficially own more than 50% of the corporation’s voting equity. Rates that are listed do not include applicable (HST). A basis point (BPS) is a unit that is equal to 1/100th of 1 per cent.